One of the biggest problems Satoshi Nakamoto had to solve when proposing his Bitcoin whitepaper was how to validate transactions. As cryptocurrency is decentralized and doesn’t rely on financial institutions, he opted for a method called Proof of Work (PoW).

PoW has been around since the early 1990s and was used as a means to mitigate email spam, but it was Satoshi who first used it in the context of digital money. It’s currently being used by Bitcoin and Litecoin, for example.

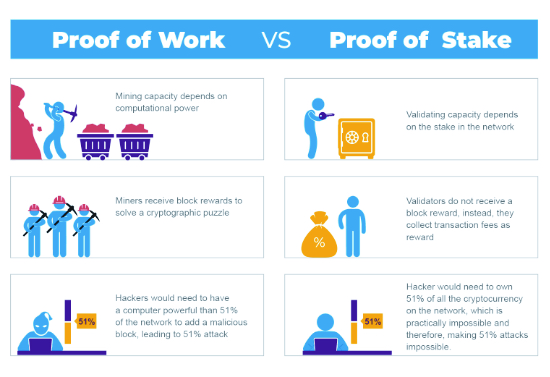

Proof of Work, otherwise known as a consensus mechanism, works like this. To validate a transaction, virtual miners around the world need to solve complex mathematical problems. The winning solution is broadcast to the network and other miners need to verify if it is indeed correct. If so, then the original miner gets to update the blockchain with the verified transaction and, as a reward, he’s given a predetermined amount of crypto.

As the value of cryptocurrency grows, more and more miners are incentivized to join the network, which increases both its security and strength.

But it’s not without its drawbacks.

The first issue with PoW – and it’s a major one – is that it’s super energy-intensive. According to the Bitcoin Energy Consumption Index, as of 26 October 2021, Bitcoin needed 181.62 terawatt-hours of power – that’s more than many countries use in an entire year!

Apparently, we’re talking about close to half a percent of all the electricity consumed in the world, and it has increased tenfold over the past five years.

People are getting increasingly concerned about Bitcoin’s carbon footprint and you might recall Elon Musk’s changing stance on being allowed to buy Tesla’s with the cryptocurrency.

Another offshoot is that Bitcoin miners generate substantial e-waste because the ASIC machines they use only serve one purpose. Also, PoW is super limited in terms of the number of transactions it can process simultaneously.

Transaction fees are also high with PoW, and we saw an increase of 750% (to $417 million) in the second quarter of 2021.

Then there’s the second issue with PoW and that is one of security. Bitcoin is susceptible to what’s known as a Tragedy of Commons scenario. This speaks to a time in the future when there will be fewer Bitcoins to mine, due to the 21 million cap and the little-to-no block rewards for mining.

Block rewards for Bitcoin miners get halved every 4 years until the final one is minted. After that, the only fees that miners will get will be transaction fees, and these will also diminish over time.

The upshot is that this might result in fewer miners, which would then make the network more vulnerable to a 51% attack. What is that, you ask? That’s when a miner, or a mining pool, controls 51% or more of the computational power of the network. They can then create fraudulent blocks of transactions, which they will benefit from while invalidating the transactions of other networks.

Proof of Stake offers a solution to these problems. Created in 2012 by developers Scott Nadal and Sunny King, it was first used with Peercoin, and is now used by Cardano, Neo, Dash,Tezos, and Algorand. Oh, and Ethereum is switching over to PoS due to the sheer number of smart contract transactions.

With PoS, the owner of a cryptocurrency can pledge their coins to be used to validate transactions. A stake is based on the number of coins a person has for a specific blockchain that they want to forge (“forge” rather than “mine” in this scenario).

The first thing you’d need to do is put your coins in a specific wallet. This freezes the coins while they’re being used to stake. Most PoS blockchains also have a minimum requirement of coins needed to stake.

Right, so the process can get a bit technical but the upshot is that once a validator checks that everything is as it should be, the block is then added to the blockchain and the forger gets a reward. If the info is deemed inaccurate, the forger loses some of their staked holdings as a penalty.

Now let’s come back to how PoS attempts to solve the issues introduced by Proof of Work, along with raising some other interesting points. In terms of security, those who stake are going to want to keep the network secure and do the right thing. Forgers face the risk of losing their substantial stake if they process malicious transactions.

Another point worth noting is that just 4 mining pools control more than 50% of the total Bitcoin mining power, which is of course unfair. PoS prevents people from joining forces to dominate a network.

When it comes to electricity use, Proof of Stake doesn’t require complex sums to be solved, and that translates into far less electricity being used, which means faster speeds and lower transaction fees.

Our 51% attack also fails under the PoS system. In this scenario, the bad apple would need to stake at least 51% of the total amount of crypto in circulation! Also, they’d need to buy these on the open market, which would lead to a decrease in the value of the coin. So they’d spend more than they would gain in such an attack.

In terms of e-waste, there would be none of that in a PoS-governed network.

Lastly, when it comes to the number of transactions that can be done on PoW versus PoS, because you’re not solving problems, it means the process is a lot faster, and therefore the fees are markedly lower.

Proof of Stake then is definitely the way of the future. It’s not without its own challenges, naturally, but it’s clear to see that this is where blockchain transactions need to be heading. It will be interesting then, to see what Bitcoin and Litecoin do in the future.

References

Lyle Daly, 24 September 2021, What Is Proof of Stake (PoS) in Crypto?, The Motley Fool

Jake Frankenfield, 21 April 2021, Proof of Stake (PoS), Investopedia,

https://www.investopedia.com/terms/p/proof-stake-pos.asp

Laura M., 19 May 2021, Proof of Work vs Proof of Stake: Which One Is Better?, BitDegree,

https://www.bitdegree.org/crypto/tutorials/proof-of-work-vs-proof-of-stake

Proof of Work vs Proof of Stake, The Beginner’s Guide, Kraken

https://www.kraken.com/learn/proof-of-work-vs-proof-of-stake

What is “proof of work” or “proof of stake”?, Coinbase

https://www.coinbase.com/learn/crypto-basics/what-is-proof-of-work-or-proof-of-stake

Jeff Benson & Matt Hussey, 14 May 2021, What is Proof of Stake? How it Differs From Proof of Work, Decrypt.co

https://decrypt.co/resources/proof-of-work-vs-proof-of-stake

How Bitcoin Fees Work, River.com

https://river.com/learn/how-bitcoin-fees-work/

Analytics Insight, 5 October 2021, Bitcoin transaction fees spiked by 750% to $417 million in Q2 2021, nearly ten times last year’s total, Analyticsinsight.net

Proof of Work vs. Proof of Stake, Kraken

https://www.kraken.com/learn/proof-of-work-vs-proof-of-stake

Leave a Reply