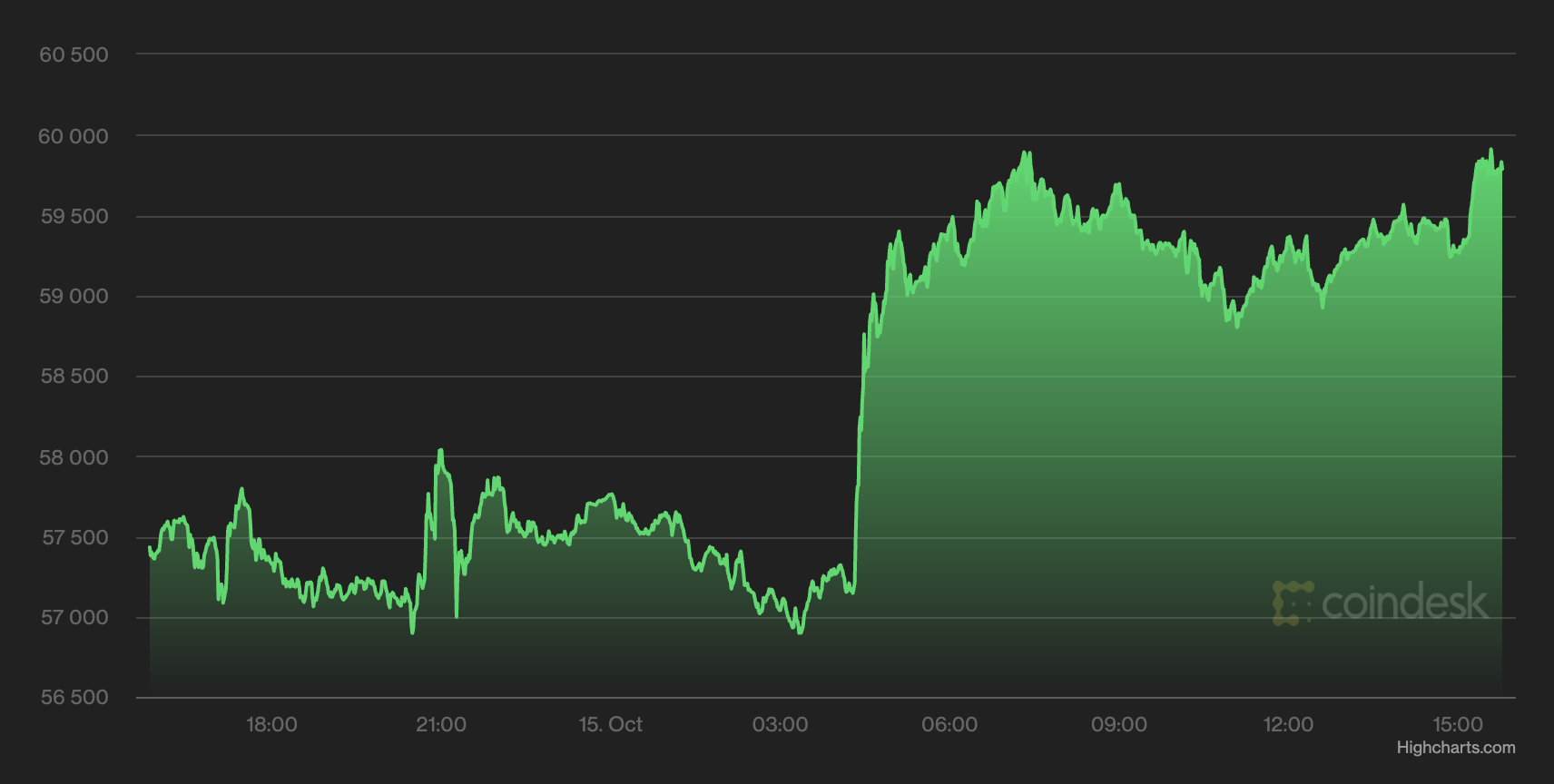

With the long-awaited approval of a Bitcoin exchange-traded fund by US regulators expected imminently, crypto markets have reacted positively, with the price of Bitcoin nearing $60,000.

Late Thursday, Bloomberg reported that the United States Securities and Exchange Commission (SEC) is preparing to allow the first US Bitcoin exchange-traded fund (ETF) to begin trading as early as next week. The news outlet cited sources familiar with the matter for the scoop.

The candidates

There are currently around 40 Bitcoin and other crypto-specific ETF applications that are being reviewed by the SEC. Valkyrie Investments, ProShares, VanEck, and Invesco are all in line for an October decision.

Unlike most other governmental agencies, the SEC applications don’t strictly need to be approved. By allowing the deadline to make a decision to lapse without asking for any amendments or clarifications would allow an applicant to begin trading.

The impact

Based on the resurgence of Bitcoin, which dropped below $30,000 as recently as July, and the general sentiment on social media, any decision in favor of a bitcoin ETF would see crypto prices soar. However, not everyone is as confident.

During Bloomberg’s QuickTake Stock streaming program, Juthica Chou attempted to manage market expectations.

“An ETF will definitely be a positive. It’ll expand the breadth of the participants that can start buying Bitcoin and taking part in the ecosystem. But it won’t be as impactful as it would have been years ago because we’re already seeing institutional demand.”

Is the long road almost at an end?

The first application for a Bitcoin ETF was submitted to the SEC by Cameron and Tyler Winklevoss, yes, the Facebook Winklevoss twins, in 2013. After an eight-year campaign by crypto advocates, SEC Chair Gary Gensler finally signaled that the commission was open to the idea in August, stipulating only that policymakers would prefer if it was based on futures instead of the cryptocurrency itself.

Leave a Reply