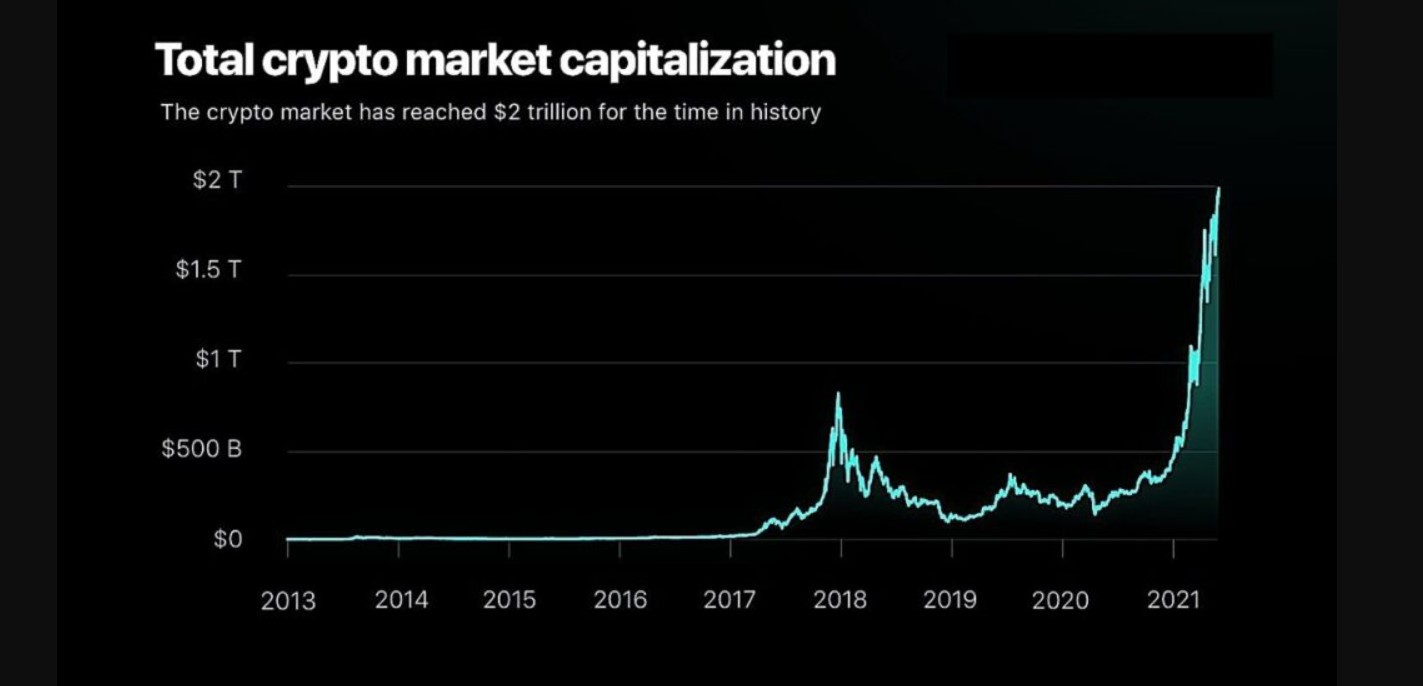

Monday 5 April 2021 will go down in history as the day when the total market capitalization of the digital asset industry peaked at over $2 trillion. This is an all-time high for the crypto market and reflects the recent increase in investment demands from major companies in both the institutional and retail sectors.

Experts say that altcoins have benefited majorly from the increased use and demand of stablecoins which are pegged directly to fiat currency values such as the USDC coin. They believe that price rallies for these digital assets besides bitcoin, have helped push the total crypto market cap over the $2 trillion mark.

And Bitcoin?

Bitcoin has managed to hold a $1 trillion market cap for an entire week which has helped to lead the surge in the overall crypto market value. As bitcoin hit its record high of $61,000 in March, it has been trading quite steadily since.

The bitcoin price has doubled in the last year and seems to be at a halt in recent weeks as altcoins have taken the lead in dominating the crypto market value. Bitcoin now holds around 57% of the total market compared to 73% at the beginning of the year, following research from TradingView.

According to crypto analysts, the bitcoin market cap could maintain the $1 trillion mark if the price stays above $53k. Of course, this remains to be seen. Glassnode, the blockchain intelligence platform, believes that bitcoin holding the $1 trillion market value is a “strong vote of confidence for bitcoin and the cryptocurrency asset class as a whole.”

They went on further to say “On-chain activity continues to reinforce this position with a volume equivalent to over 10% of circulating supply transacting above the $1 Trillion threshold.”

Are altcoins taking over?

Ethereum has shown major growth in the past few weeks as it proceeded toward the all-time high price of $2,100 last week. The demand for Ether has grown rapidly due to the popular belief that the Ethereum network would become the network of choice when it comes to decentralized finance and might one day replace technology used by banks and other financial institutions.

“Galen Moore, CoinDesk Research’s director of data and indexes, wrote in an analysis that the outstanding performance during the latest “altcoin season” has come from digital tokens belonging to so-called smart-contract platforms that could compete with Ethereum or complement it.” in a recent article from CoinDesk.

Visa has recently announced that it would be settling transactions using the Ethereum blockchain and the USDC coin which has led to major interest and demand for this digital asset. However, the rise in popularity of the Ethereum network has increased transactional fees as the network experiences more traffic and congestion.

We have seen some other major developments in the crypto industry recently as PayPal has also launched its Crypto Checkout Service in late March this year, not to mention Tesla’s big announcement that they will be accepting Bitcoin as payment for their vehicles.

This has certainly been a very exciting time for the crypto industry as we see these major advancements taking place and it seems like there’s big news almost every day. We’ll be keeping a close eye on future developments within the crypto world so make sure you keep an eye on our news page.

Leave a Reply