Leading crypto trading platform Binance is opening up to the trade of tokenized stock from some of the biggest companies in the world.

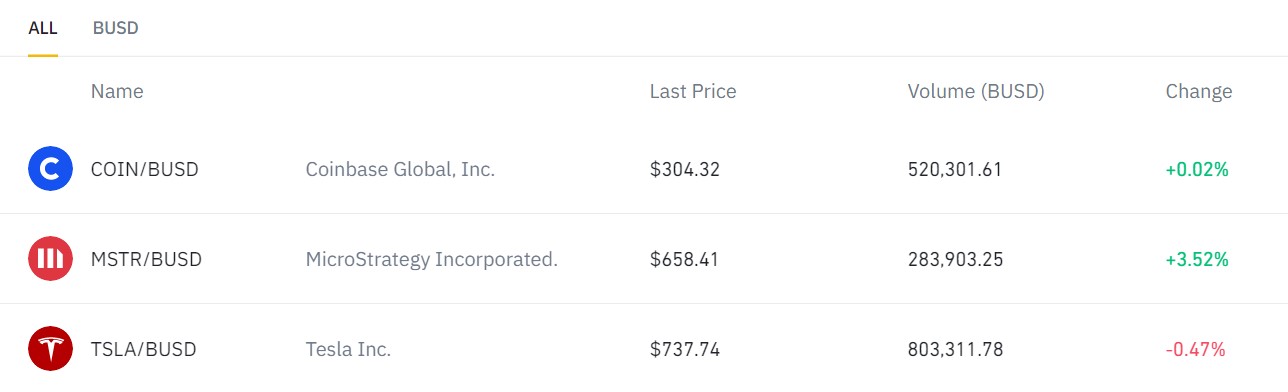

Binance made their move into tokenized stock trading earlier this month when the major e-car manufacturer Tesla’s stock became available for trade in the form of a token on this popular platform. They have also added fractional shares of their rivaling exchange Coinbase after it went public on April 14.

Now, Binance has announced that it will be listing tokenized shares of Microsoft, Apple, and MicroStrategy by the end of April this year.

Users already have the opportunity to trade MicroStrategy stock as of yesterday, 26th of April in this swift move from Binance. They are planning to list Apple stock tokens by the 28th and Microsoft by the 30th of this month.

All tokenized stocks available for trade through Binance are denominated in the BUSD (Binance USD) stablecoin. Stablecoins are digital currencies that peg their value to already existing fiat currencies to avoid price volatility associated with cryptocurrency much like the DCash in the Caribbean and the possible new digital Pound of the U.K.

These stock tokens from Binance have been under some scrutiny recently, according to a report from Coindesk: “Red flags have already been raised by Hong Kong law firms regarding the two tokens launched earlier this month, which allow Binance customers to purchase as little as one-hundredth of a regular stock using Binance USD (BUSD), a U.S. dollar stablecoin issued by the exchange.”

But Binance says that the products comply with the EU’s Mifid II market rules and BaFin’s banking regulations. They also say that the products don’t require a prospectus as the tokens can only be purchased and sold within CM-Equity, which is a regulated investment group based in Munich and processes the trade of these tokens.

Binance has also announced that it will monitor the market demand and look at providing more Stock Tokens issued and sold by CM-E, they are also offering commission-free stock trading on their platform.

What are Binance stock tokens?

Equities are stocks that trade on traditional exchanges like the NYSE or NASDAQ. Tokens are pegged to the price and performance of these equities. If the price rises, the price of the stock token is expected to rise accordingly. If the price falls, the price of the stock token is expected to fall.

“Binance Stock Tokens are tokens of stocks (i.e., shares of public companies) that trade on traditional stock exchanges. Each Stock Token represents one ordinary share of the relevant stock. These Stock Tokens are fully backed by a depository portfolio of underlying securities held by CM-Equity AG, Germany (“CM-E”). Holders of Stock Tokens will qualify for economic returns on the underlying shares, including potential dividends.” according to Binance’s official announcement.

It is also worth noting that users from the U.S., China, and Turkey are prohibited from trading stock tokens and that all Binance stock tokens are only tradable during the market hours of the United States.

Leave a Reply